Interim Management

Vacancy Bridging and Restructuring

Food Resource Management supports you in exceptional corporate situations, such as bridging management bottlenecks and implementing crisis-related reorganisation measures, right through to complex project management.

Learn more

Interim Management

Vacancy Bridging and Restructuring

Food Resource Management supports you in exceptional corporate situations, such as bridging management bottlenecks and implementing crisis-related reorganisation measures, right through to complex project management.

Learn more

Optimisation

Responsibility at home and abroad

Food Resource Management supports you in exceptional business situations, such as bridging management bottlenecks and implementing crisis-related reorganisation measures, right through to complex project management. We bring the necessary know-how to your company so that you can act flexibly and quickly in the market. Our independence in terms of corporate policy enables us to consistently implement even unpopular measures. We are flexible and can be deployed at short notice, usually within a few days.

Interim management industry forecasts clearly positive market development

DDIM Forecast // 2022 – The high pre-Corona level is exceeded in all parameters.

- Interim management market to grow to over 2.5 billion euros in 2022

- 12,000 interim managers available to meet corporate challenges by the end of 2022

- Daily rates develop positively and reflect the high level of quality

- Interim manager utilisation rate will rise to over 90% in 2022

Cologne, 18 March 2022 – The umbrella organisation Deutsches Interim Management e.V. (DDIM), Germany’s industry and trade association for professional interim management, has once again presented the results of the DDIM Forecast Survey for 2022. It is the result of the annual survey among the more than 550 members of DDIM as well as the almost 30 interim management providers who are associated with DDIM as partners.

DDIM forecasts a positive overall market development for interim management

The development of the total market volume is probably the strongest indicator for determining the state of the entire interim management industry. The precise analysis with the subsequent task of drawing the right conclusions is a core task of DDIM. As a neutral authority, the association provides orientation in the market. After a Corona-related slump in 2020 and a recovery in 2021, there is now clearly positive news: The forecast is positive in all parameters that influence the overall market development.

12,000 interim managers available to meet corporate challenges by the end of 2022

The number of interim managers increased slightly to 11,500 in 2021, and both interim managers and providers forecast a further increase for 2022, so that a total of 12,000 interim managers can be assumed by the end of 2022.

Daily rates develop positively and reflect the high level of quality

The respondents forecast an average daily rate of 1,267 euros. of 1,267 euros. In 2021, the daily rate was just under 40 euros below the level forecast for 2022. It should be noted that this is an average value with a very wide range, which results, for example, from different tasks and functions or also responsibilities with regard to personnel management and results.

Interim manager utilisation rate will rise to over 90% in 2022

The utilisation rate of interim managers averaged 81% in 2021. This was a good 7 percentage points higher than in the first year of the pandemic, when managers achieved an average utilisation rate of 74%. For 2022, the interim managers forecast a further increase in the utilisation rate to 91%. The duration of mandates is forecast at 11.5 months for 2022. This is a good month higher than in 2019, the year before the pandemic. Total market volume of interim management rises to 2.5 billion euros at the end of the year. This results in a total market volume of 2.5 billion euros. The forecast value also takes into account the providers’ assessment that the market will develop slightly or even very positively in 2022.

Overall, there is a positive development on the demand side. Some issues that are now leading to increased demand for interim managers are the result of the pandemic: procurement bottlenecks, disrupted supply chains, project postponements as a direct result of Corona or upcoming financing rounds. However, the shortage of skilled workers is also clearly felt in companies, and digitisation and transformation projects are on the horizon. SMEs in particular are facing massive changes and challenges that can now be tackled with interim managers.

Source: Press release DDIM Forecast from 18.03.2022

Customised solutions

Case studies from practice

Task:

Increasing delivery capability and improving productivity, as well as interim operations management.

Industry:

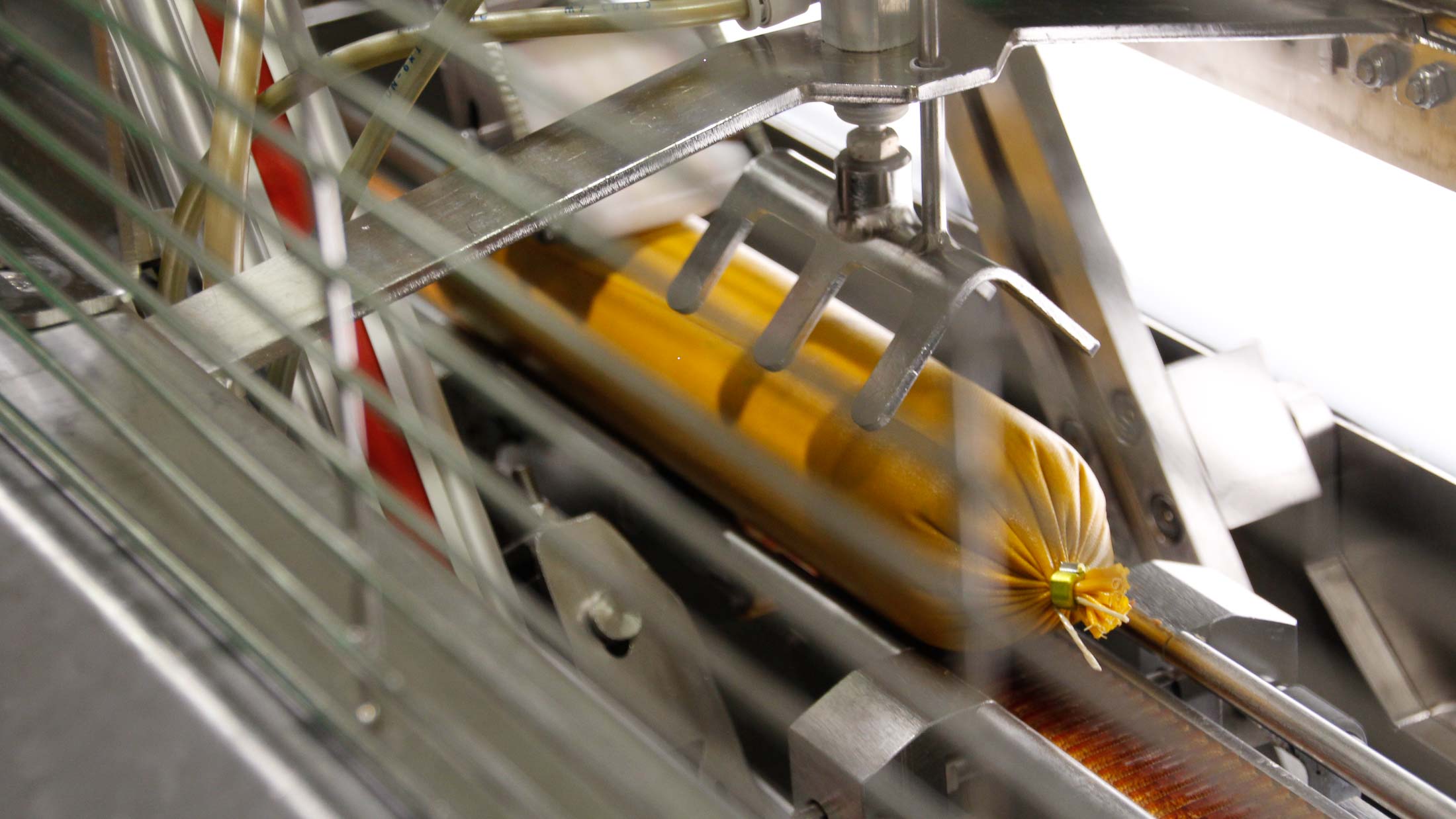

Confectionery industry; Company: Medium-sized company / 130 employees

Project duration:

6 months

Practical example 1

Successful reduction of personnel and cleaning costs

By using box inlays (plastic bags) in transport boxes for chocolates, the cleaning interval of the boxes was reduced by 800%. Cleaning a crate costs 70 cents. The inlay costs only 7 cents. The annual cleaning costs could be reduced by 175,000 €. In addition, this measure reduced the crate stocks, as crate resources were tied up by the time-consuming cleaning processes.

Practical example 2

Increasing productivity by changing staff scheduling

For a high-priced product of a marzipan manufacturer, the line throughput could be increased by 50% through additional personnel deployment of +25% on a decorating line. The resulting increase in turnover of €3,000 bears no relation to the increased personnel costs per shift of €100. In addition, the company had previously had delivery problems and, due to the seasonal business at that time, was working at 120% capacity on the basis of 5 days in three-shift operation. The success achieved led to an increase in productivity (there was more throughput per employee) and also to an improvement in delivery reliability.

Practical example 3

Interim operational management and delivery capability

The position of the previous plant manager was filled by Food Resource Management due to proven capability-related management problems. Through the restructuring and optimisation in the cleaning area and the outsourcing in the packaging area, as well as through maintenance and various other measures, productivity was increased by 23% and the technical availability of the plants by 34%. In addition, 100% delivery capability was ensured. Furthermore, an improvement of the operating result of € 1.5 million was achieved as well as the delivery capability by 20%.